Endowment and investment strategy

In a nutshell

The long-term capital of Aalto University Endowment is invested in the financial markets with the purpose of generating funding for its academic activities. The endowment was set up by a fundraising campaign and government capitalization between 2008 and 2012, which generated a total of EUR 700 million. EUR 50 million in investments from special purpose funds of the three merged universities is also a part of the endowment.

Endowment portfolio comprises of capital from Aalto University general endowment fund as well as capitalizing and hybrid funds. Ownership of subsidiary companies as well as real estate, real estate investments, apartments and other operative assets are excluded from the endowment portfolio.

Ilkka Niemelä, President of Aalto UniversityThe endowment has enabled long-term investments towards increasing demand in research and education for future years.

Supporting the university

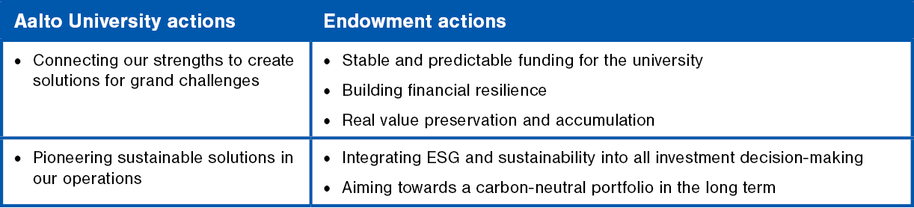

The main purpose of the endowment is to generate annual funding for Aalto University's operations to enable the university to fulfil its strategic goals as well as support high-quality education, research and innovation. The endowment provides the university with financial independence and enhances funding stability, both of which are deemed fundamental requirements for a top-class university.

Read our 2024 review for donors to learn more

Spending policy

Endowment Spending Policy sets principles for defining the level of spending from the endowment towards the university operations. The predefined spending policy provides a clear and transparent way to determine future endowment spending, that will support the annual operative planning of the University and donor communications, and sets a clear target for the endowment strategy, including a strategic risk/return profile of the endowment portfolio.

The general endowment fund and capitalizing funds have a target spending rate of 2.5% per year, which is based on an expected long-term real return, in other words, a return above the inflation rate. This ensures that these funds will grow in line with inflation and can therefore support academic activities consistently and sustainably. Hybrid funds spend their fixed nominal return of 5% as well as the capital itself during the pre-determined duration of the funds.

The actual annual spending is decided by the Aalto University Board each year and stability acts as the key factor in that decision-making. Changes in the portfolio market value and the overall funding of the university are also considered.

Key figures of 2024 and annual reports

On this page, we present key figures of 2024 and the Annual Board Report and Financial Statements.

Long-term investment strategy

The cornerstone of our investment strategy is our purpose – providing funding for the university while accumulating the real value of the endowment. Reaching these goals requires prudent and consistent risk taking over time. Concurrently, we maintain adequate liquidity in the portfolio to ensure our ability to cover the medium-term funding needs regardless of the market environment. Investments in private assets and the implementation of more advanced investment strategies will also be done when they offer attractive expected returns.

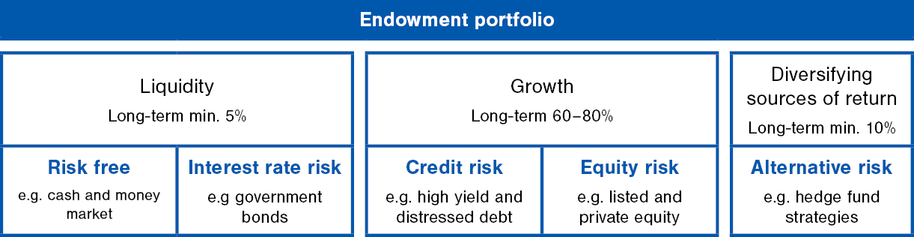

The portfolio structure is based on risk categories. Asset classes are grouped in the portfolio based on their primary risk. The structure aims to combine academic theory and our sound investment judgment. The three risk categories are liquidity, growth and alternative risk. Most of the portfolio is allocated to the growth category, which comprises equities and equity-type risk.

The endowment invests primarily through funds and exchange traded funds (ETFs). The university’s internal team focuses on long-term investment strategy, asset allocation and manager selection. We partner globally with leading asset managers to implement the investment portfolio, and the individual security selection is outsourced to external portfolio managers.

Responsibility and sustainability

The purpose of Aalto University is to shape a sustainable future through research, education and positive societal impact. The endowment contributes to this purpose directly by enabling these academic activities via its annual funding and building financial resilience. We are committed to responsible investing and managing the endowment in a sustainable way in line with our values. Aalto University is a signatory to the Principles for Responsible Investment (PRI) and a member of FINSIF and Standards Board for Alternative Investments (SBAI).

Read more on Aalto University's strategy and how we shape a sustainable future

Approaches to responsible investing

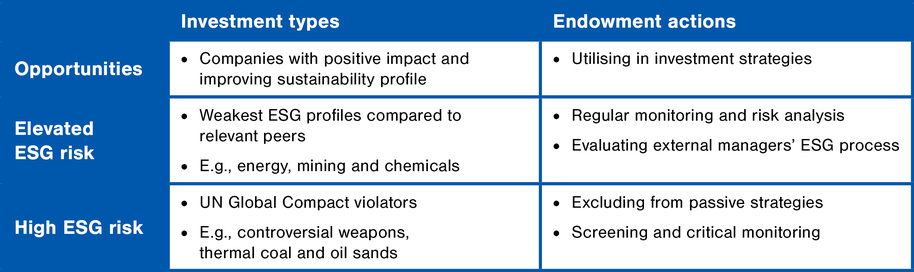

As we invest through investment funds, a key part of the investment process is selecting and monitoring these external fund managers. Our external managers are encouraged to use multiple approaches to responsible investing. For example, exclusions are a useful tool for some investment strategies, whereas integrated ESG (Environmental, Social, and Governance) analysis and active ownership can bring better results and impact on others. Our focus is always forward-looking, which means that the expected impact of investment decisions is evaluated.

Responsible investing must be balanced between both risks and opportunities. In short, we control our exposure to investments with a high ESG risk and negative impact, while aiming to increase our exposure to investments with a positive ESG profile and impact.

Our long-term target is to have a carbon neutral portfolio. As a medium-term target, we will significantly reduce the carbon intensity of our portfolio. This is to be implemented gradually from 2021 to 2030 and we will begin reporting on carbon intensity and other responsible investing indicators in 2021.

Our long-term target is to have a carbon neutral portfolio. As a medium-term target, we will significantly reduce the carbon intensity of our portfolio. This is to be implemented gradually until 2030. Thereafter, we target a declining trend of carbon emissions in line with global climate benchmarks. A more detailed description of our sustainability profile and roadmap to 2030 and beyond can be found in the latest release of our sustainability report and the latest endowment strategy publication.

Management and oversight

Chief Financial Officer Marianna Bom

- Authorizations and risk limits, spending policy

Head of Investments Lauri Ström

- Investment strategy, asset allocation and manager selection

Portfolio Manager, Deputy Head of Investments Filip Hintze

- Private markets investments, asset allocation, portfolio analysis, sustainability analysis

The Aalto University Foundation Board approves and supervises the implementation of the endowment strategy and approves authorizations and risk limits.

The Investment Committee advises the board on decisions regarding the endowment and advises the Head of Investment on forming and implementing the endowment strategy.

- Chair Markus Aho, CIO, Varma Mutual Pension Insurance Company

- Member Sami Tuhkanen, Vice president, Investments, Sitra

- Member Timo Viherkenttä, Professor of Practice Aalto University School of Business

- Member Heikki Westerlund, Chairman of The Board, Aspo Plc

Contact us

Endowment news

Lauri Ström appointed Head of Investments

Ström will be responsible for the investment portfolio and investment strategy

Will future experts be educated with fewer euros?

Universities struggle with shrinking funding while expectations continue to rise. New revenue streams and broad societal support are more critical than ever.Aalto University endowment provided EUR 41 million in 2024 for education and research

The university endowment portfolio returned 11.2%