Managing transition risks

Climate action failure is a key blind spot in the collective response to global risks, according to the World Economic Forum. If no action is taken, climate change effects of unpredictable magnitude could have wide-ranging consequences, such as financial instability and job losses. The shift to decarbonization, however, poses risks for firms transitioning to low-carbon strategies. Thus, the need to reduce global carbon emissions presents a conundrum to business.

The concept of transition risks emerged in the financial sector and is now topical for various industries. Firms are becoming aware of the need to integrate transition risks into corporate agendas by converting climate risks into manageable risks. Effectively managing transition risks is crucial for the resilience of businesses in global value chains. Low-carbon new growth is the investment trend for post-pandemic economic recovery policies and the European Green Deal.

Managing Transition Risks in Risk Bearing Value Chains (T-Risk)

This research project is funded by the Wallenberg Foundation (Marcus Wallenbergin Liiketaloudellinen Tutkimussäätiö) in 2021-2023.

The marine and aviation industries are the focus of the T-Risk project.

Transition risks translate uncertain climate risk into well-known management problems, thereby establishing a bridge between climate risk responses and actual strategic change. They include market risks arising from shifts in market preferences, regulatory risks arising from changes in climate policy, technology risks created by radical technological changes, and reputational risks induced by liability concerns in a predominantly low-carbon future. There is growing interest in transition risks. They will gain traction in corporate management as a key issue in the near future.

“The most problematic risk is still climate change. There is no vaccine for this.” –Saadia Zahidi, managing director, World Economic Forum

“Can we know the risks we face, now or in the future? No, we cannot; but yes, we must act as if we do.” –Mary Douglas and Aaron Wildavsky

The project focuses on how firms manage these transition risks in order to survive the long-term and structural changes brought about by the impacts of climate change. Little is known about how transitions risks are integrated into strategic and organizational activities. But firms are becoming aware of the need to integrate transition risks into corporate agendas. They are urged now to act upon climate risk policies affecting their strategy.

Focus on risk-bearing value chains: Potential for high impact research

Maritime and aviation firms are critically exposed to the carbon-intensive business models of major risk producers and have begun to develop strategies for long-term decarbonization. Managing transition risks in both sectors implies systemic changes. Firms can potentially disseminate best practices, thus amplifying their transition risk management impact across the value chain.

Sub-projects

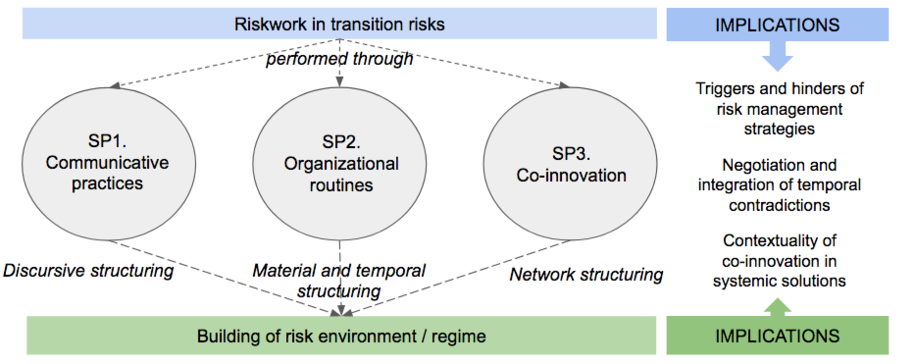

T-Risk includes 3 sub-projects that analyse different dimensions of the management of transition risks in the marine and aviation sectors.

SP1. Communicative practices

Aim: Understand the role of communicative practices and communication in shaping the organizational attention and practices on the transition risks

How? We analyze public discursive strategies of organizations to legitimize or challenge their practices, to unfold convergence and contestation in the discourses around transition risk management, as a source of stability or change.

SP2. Organizational routines

Aim: Understand how companies address the temporal dimensions of transition risks through riskwork, e.g., anticipating events, producing scenarios, and developing models to determine future risks.

How? We analyze visual and material representations of risk which shape organizational routines and strategies.

SP3. Co-innovation

Aim: Understand how managing transition risks functions as a trigger for systemic and collaborative innovation, including integrating stakeholders for practical risk mitigation.

How? We analyze case studies of partnership initiatives to examine interlinkages between contextual and firm-specific factors (including stakeholder collaboration practices and governance structures) leading to novel systemic solutions.

Deliverables

Research privacy notice

For research participants: Downloadable file (coming soon)

Communications

Jouni Juntunen